Weekly Market Commentary 08.15.2022

The Markets

Rally caps were waving.

In recent weeks, investors have embraced the idea that economic data will persuade the Federal Reserve to slow the pace of rate hikes. Last week’s inflation data fanned their enthusiasm.

The big news was that the Consumer Price Index (CPI), which measures inflation, didn’t change from June to July. That doesn’t mean all prices remained the same during the month. They didn’t. For instance, the cost of energy dropped by 4.6 percent, while the cost of food rose by 1.1 percent. When all price changes were combined, the overall result was zero percent inflation for July. Year-to-year, though, the CPI was up 8.5 percent.

Investors didn’t care that a single month is not a trend, and stocks moved higher. “The gains this week continue a longer run for the stock market, which had already been optimistic that evidence would point to peak inflation…The hope is that cooling inflation will make the Federal Reserve more likely to slow down the pace of interest rate hikes,” reported Joe Woelfel and Jacob Sonenshine of Barron’s.

“That narrative got another boost Thursday. The producer price index for July gained 9.8% year-over-year, below expectations for 10.4% and below June’s result. That further validates the peak inflation thesis, as companies would raise prices at a slower pace, given that their costs are rising at a slower pace.”

The bond market was less optimistic about what the future may hold. The U.S. Treasury (UST) yield curve steepened after CPI data was released, which suggests some optimism about the future. However, the curve remained inverted, suggesting that bond investors think the current Federal Reserve policy – raising rates and tightening monetary policy – may eventually lead to a recession, reported Liz McCormick of Bloomberg.

Bloomberg’s July survey of economists put the chance of a recession within the next year just below 50-50, reported Vince Golle and Kyungjin Yoo.

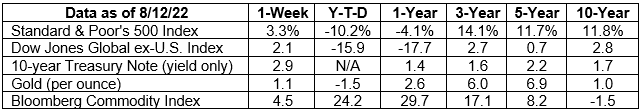

Last week, the Standard & Poor’s 500 Index delivered a fourth consecutive week of gains, the Dow Jones Industrial Average trimmed its losses for the year, and the Nasdaq Composite was up 20 percent from its June low, reported Andrew Bary of Barron’s.

WHERE ARE THE BEST PLACES TO LIVE IN NORTH AMERICA?

This year, the Economist Intelligence Unit conducted a “liveability” study to evaluate which cities around the world had the most to offer residents. They analyzed 30 quantitative and qualitative factors across five categories – stability, healthcare, culture and environment, education, and infrastructure – in 172 cities.

As it turns out North America is the second most livable region of the world, trailing just behind Western Europe. Every North American city in the survey received a score of at least 80 out of 100. The top cities in North America included:

1. Calgary

2. Vancouver

3. Toronto

4. Montreal

5. Atlanta

6. Washington, D.C.

7. Honolulu

8. Pittsburgh

9. Los Angeles

10. Seattle

The desirability of North American cities may explain why more people are moving to the continent. “Over 630,000 people moved to North America from other parts of the world in the first half of 2022, a rise of 51% from the same period a year earlier,” reported The Economist.

In case you’re wondering, the least livable cities in North America – and no place had a low score – were Lexington, Detroit, Houston, Cleveland and New York.

Where would you live if you could choose anywhere in the world?

Weekly Focus – Think About It

“We all have our time machines, don't we? Those that take us back are memories...and those that carry us forward, are dreams.” —H.G. Wells, author

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.barrons.com/articles/stock-market-today-51660151669 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-15-22_Barrons_Dow%20Rises%2c%20Disney%20Surges_2.pdf)

https://www.bloomberg.com/news/articles/2022-08-11/bond-traders-dismiss-stock-market-rally-as-misguided-euphoria?srnd=fixed-income (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-15-22_Bloomberg_Bond%20Traders%20Dismiss%20Stock-Market%20Rally%20as%20Misguided%20Euphoria_3.pdf)

https://www.bloomberg.com/news/articles/2022-07-15/odds-of-us-recession-within-next-year-near-50-survey-shows#xj4y7vzkg (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-15-22_Bloomberg_Odds%20of%20US%20Recession%20Within%20Next%20Year%20Near%2050%20Percent_4.pdf)

https://www.barrons.com/articles/stocks-could-keep-rising-if-the-fed-shows-restraint-51660354321?mod=hp_LEAD_4 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-15-22_Barrons_Bye%20Bye%20Bear%20Market_5.pdf)

https://www.economist.com/graphic-detail/2022/08/05/the-best-places-to-live-in-north-america (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/08-15-22_The%20Economist_Best%20Places%20to%20Live%20in%20North%20America_6.pdf)