Weekly Market Commentary 07-12-2021

The Markets

There was a gapers’ block in financial markets last week as equity investors slowed to see what the United States Treasury bond market was up to.

U.S. Treasury bonds rallied last week. Yields on 10-year Treasuries dropped from 1.43 percent at the start of the week to 1.27 percent on Thursday. The rally was quite a surprise, reported Randall W. Forsyth of Barron’s. “After all, the economy has been booming, accompanied by rising inflation – exactly the opposite of what would be conducive to lower [bond] yields and higher [bond] prices.”

As 10-year Treasury yields reached the lowest level since February, stock investors took time to consider what might have caused yields to retreat. Lower yields often suggest slower growth ahead. There may be potential for global growth to slow if:

A new wave of COVID-19 swamps the global recovery. Twenty-four U.S. states saw the number of COVID-19 cases move higher by 10 percent or more last week, reported Aya Elamroussi of CNN. The Delta variant of the virus accounts for more than one-half of all new cases. Last week, the global death toll reached 4 million and Japan, host of the 2020 Olympic games, declared a state of emergency.

China’s banking system is in trouble. There was another surprise last week. “…China’s central bank announced a half a percentage point cut to banks’ reserve ratio requirements, potentially increasing the profitability of their loans but also stirring concerns about the health of their balance sheets following a debt-fueled property boom,” reported Naomi Rovnick, Thomas Hale, and Francesca Friday of Financial Times.

U.S. economic growth falters as monetary and fiscal stimulus recede. “…the bond market is now adjusting to the prospect of more moderate growth in the second half, with reduced fiscal largess and no $1,400 or $600 stimulus checks. And it’s looking ahead to the eventual prospect of the Federal Reserve throttling back its securities purchases, which currently pump $120 billion a month into the financial system,” reported Barron’s.

Investors shook off the bond market’s signal and took advantage of buying opportunities created by the dip, reported Financial Times. Major U.S. stock indices finished the week at record highs. On Friday, 10-year Treasury yields finished at 1.36 percent.

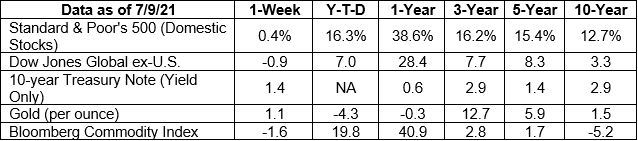

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

When was the Euro 2020 tournament played?

If you’re a soccer fan, you know the answer is last month. The tournament took place in 2021, although the name was not changed because the tournament was intended to celebrate the 60th anniversary of the European Football Championship, which occurred in 2020, reported Joe Sommerlad of The Independent. Also, the merchandise had already been produced with a 2020 logo.

The tournament final (England vs. Italy) had yet to be played when this was written, but it’s never too early for tournament trivia. See what you know about Euro 2020 by taking this brief quiz.

- There were more ‘own goals’ in Euro 2020 than in all other European championships combined. How many were there before the final match?

- 5

- 6

- 9

- 11

- What is the nickname of the Italian national team?

- Il Nerazzurri (The Black and Blues)

- Gli Azzurri (The Blues)

- Le Rondinelle (The Little Swallows)

- Il Toro (The Bull)

- How many major tournaments had the English national team, nicknamed The Three Lions, won before the Euro 2020 final?

- 1

- 2

- 3

- 4

- Euro 2020 prize money was about 10 percent higher than Euro 2016 prize money. Every team that participated in the tournament earned about £8 million (about $11 million). How much did the team that lifted the winning trophy earn?

- About £12 million (about $17 million)

- About £17 million (about $24 million)

- About £24 million (about $33 million)

- About £33 million (about $46 million)

The Economist explained the importance of European football like this, “On a continent where the facets of nationhood are disappearing, be they banal (customs arrangements), the everyday (currency) or the emotive (borders), football is a way of clinging on.”

Answers: (1) d; (2) b; (3) a; (4) c

Weekly Focus – Think About It

“A champion is someone who does not settle for that day's practice, that day's competition, that day's performance. They are always striving to be better. They don't live in the past.”

– Briana Scurry, Former goalkeeper, U.S. Women’s National Soccer Team

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://finance.yahoo.com/quote/%5ETNX/history?p=%5ETNX (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-12-21_Yahoo%20Finance_Treasury%20Yield%2010%20Years_1.pdf)

https://www.barrons.com/articles/bonds-odd-behavior-may-presage-weaker-second-half-economy-51625879881 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-12-21_Barrons_Bonds%20Odd%20Behavior_2.pdf)

https://www.cnn.com/2021/07/08/health/us-coronavirus-thursday/index.html

https://www.ft.com/content/596c6ab3-e1c7-4c33-b2e0-c11077ce89a8 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-12-21_Financial%20Times_US%20and%20European%20Sotcks%20Rebound_5.pdf)

https://www.barrons.com/articles/stock-market-news-covid-19-51625874629?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-12-21_Barrons_Stock%20Market%20Can%20Continue%20to%20Grow_6.pdf)

https://www.independent.co.uk/sport/football/why-is-euro-2020-not-2021-b1865025.html

https://www.france24.com/en/live-news/20210709-make-no-mistake-euro-2020-littered-with-own-goals

https://en.wikipedia.org/wiki/History_of_the_England_national_football_team

https://theathletic.com/news/euro-2020-prize-money-england-italy/fo7GmuCaBKmD

https://www.economist.com/europe/2021/07/01/euro-2020-politics-by-other-means (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/07-12-21_Economist_Euro%202020_Politics%20By%20Other%20Means_12.pdf)

https://vocal.media/cleats/the-most-famous-soccer-quotes-of-all-time