Weekly Market Commentary 05-24-2021

The Markets

What do markets hate?

They hate uncertainty, and recently there has been plenty of it. Some of the questions plaguing economists and pundits include:

Why aren’t people returning to work? Americans, like people in other parts of the world, have not been rejoining the workforce at the pace many had anticipated. One of the most frequently cited theories was explained by The Economist:

“In America businesspeople, almost to a pinstripe, are convinced that the $300-a-week boost to unemployment insurance explains the shortages. However, pundits do not agree on whether stimulus handouts really lead people to shirk. The evidence is hazy elsewhere, too…Australia ditched its job-protection scheme in March, and shortages have worsened.”

The unemployment data has inspired many theories about why jobs aren’t filling more quickly. These include fear of contracting COVID-19, low hourly pay, and lack of dependent care, to name a few. Some states recently modified unemployment programs, so there soon may be new data to help clarify the situation.

Is the Federal Reserve thinking about raising rates or slowing bond purchases? In June 2020, Fed Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” Some are wondering whether that has changed. The minutes from April’s Federal Open Market Committee meeting, which were released last Tuesday afternoon, included a statement that raises questions. It said:

“A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

Of course, the economic picture isn’t as robust as it was in April. Since then, we’ve seen a weaker-than-expected employment report and higher-than-expected inflation data. While one month does not establish a trend, investors, economists, and pundits will be watching economic data releases closely for clues about economic recovery.

Will inflation prove to be transitory or will it persist? Investors also are worried the Federal Reserve will keep rates low for too long. James Politi of Financial Times reported:

“The Fed has argued that strong monetary support for the economy is still needed because of the risk of a slowdown in the recovery and the shortfall in employment compared to pre-pandemic levels. Nor does it expect the current spike in consumer prices to last, arguing that it is being fueled by supply chain bottlenecks and the economic reopening.”

Others aren’t so sure the Fed is right. Last Tuesday, former U.S. Treasury Secretary Lawrence Summers said the Fed’s latest forecasts suggest it is misreading the economy and encouraging complacency, reported Greg Robb of MarketWatch.

Last week, the Standard & Poor’s 500 and Dow Jones Industrial Indices moved slightly lower while the Nasdaq Composite moved slightly higher.

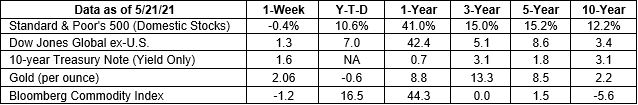

(The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Ahhh, the joys of parenting.

With Mother’s Day behind us and Father’s Day ahead, it seemed an appropriate time to share some tweets about the parenting experience. Here are a few entertaining examples shared online by parents and rounded up by Buzzfeed:

“Does anyone have directions to that village everyone says will raise my children? It sounds wonderful.” --Not Your Trending Mom

“Hi, I'm a parent. You may remember me from such greats as ‘Repeating Myself’ and ‘Arguing over Shoes’ and ‘Stepping on Cereal.’” --Rodney LaCroix

“Thoughts and prayers for my son who thought it would be funny to tell me ‘I’ll get to it when I get to it, woman.’” --Mom On The Rocks

“Why aren’t there any horror movies called ‘My 4-year-old fell asleep in the car at 5 pm.’” --threetimedaddy

“7 [year old] son: May I have some water?

Me: What are the magic words?

7 [year old] son: I can get it myself.

Me: There you go.” --Laura Marie

“Blew my nose in front of my daughter and her friends today. Please respect her privacy during this difficult time.” --Simon Holland

Parenting is never an easy job, and the pandemic made it a lot trickier. Parents have to make important financial planning decisions involving children, too. Often these are related to legacy planning, and sometimes they involve special needs. If you would like to talk about the needs of your family and identify potential solutions, give us a call.

Weekly Focus – Think About It

“It does not do to leave a live dragon out of your calculations if you live near one.” --J.R.R. Tolkien

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.economist.com/leaders/2021/05/22/what-to-do-about-a-labour-crunch (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-24-21_TheEconomist-What_to_Do_About_a_Labour_Crunch-Footnote_1.pdf)

https://www.cbsnews.com/news/enhanced-unemployment-benefits-end-worker-funding/

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20210428.pdf (Page 10)

https://www.ft.com/content/9935be40-d041-4b7d-acac-4d86f3c25100 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-24-21_FinancialTimes-Larry_Summers_Accuses_Federal_Reserve_of_Dangerous_Complacency_Over_Inflation-Footnote_5.pdf)

https://www.barrons.com/articles/bitcoin-stock-market-51621643806?mod=hp_LEAD_2 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-24-21_Barrons-Bitcoins_Tumble_Shook_Up_Stocks-What_to_Make_of_the_Markets_Messy_Week-Footnote_7.pdf)

https://www.buzzfeed.com/mikespohr/best-mom-tweets-2020-4

https://www.buzzfeed.com/asiawmclain/dad-tweets-that-keep-it-real?origin=web-hf

https://www.projectmanager.com/blog/planning-quotes