Trend Reversals: Why I like them

Years ago, while visiting investment managers in Manhattan, I had an interesting experience. I went from a reputable value manager from one side of the street to a reputable growth manager on the other side of the street. Both had compelling arguments as well as compelling statistics. They both thought their style was the only true style for investors. The growth manager asked where I was headed the next day. I told him I was heading to Connecticut to talk to a trend following manager. The growth manager gasped “Good luck with that” as if to say, “Why bother!”

This memory serves as a good reminder that there are almost infinite ways to make money. Some are clearly better than others. Some don’t last very long or take way too much risk. And some force us to sacrifice liquidity. But there are many, many different good ways to make money that work very well.

One strategy that has worked very well for investors and one that I really like is trend reversal. I like it because when the trend reverses from bad to good, it’s often when the valuation is more attractive and management is working through their issues. Mean reversion may also be at work. Quality is often improving or turning around. We know that when the trend starts turning positive from negative, momentum is also picking up.

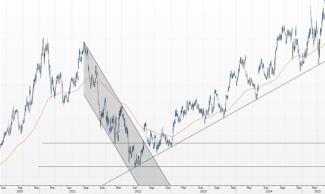

I was off-roading with a family friend the other day and I explained it differently. I told him that when there is “peak hate” or “peak fear” or “peak [insert whatever negative thing people don’t like about the company],” this usually amplifies panic selling that becomes more and more disconnected from the fundamentals. The silver lining in this, if you don’t already own the investment, is that when everyone who will turn bearish is already bearish, there are no more bears – no more marginal sellers. The next person that steps up is a buyer. The person after that is also often a buyer and so forth until the buyers outnumber the sellers and reverse the trend higher. Some of the best performance can be coming out of a very ugly place. The mystery chart above is one example of an investment that has added value for clients.

In full disclosure, I admit that trend reversal doesn’t always work perfectly in every situation, just like any investment strategy, style or factor. It’s also worth saying that companies that do have fundamentals crumbling at the same time as the price often do have bigger issues (e.g. bankruptcy, fraud, etc.) and these are not good examples of a trend reversal, because things will not typically reverse in those cases.

I really like the odds, however, when I can identify the factors of value (or mean reversion) along with quality, trend, and momentum at or close to the same time. If management is cleaning up the balance sheet, the income statement, or the statement of cash flows OR if they are rolling out a new product or new service that the markets may not have fully priced in, that’s even a better catalyst for trend reversal to work.

With investments, much like in movies or books, some of the most exciting things to behold are turnaround stories where we can see things go from bad to worse before turning around and improving dramatically. It’s similar to the classic story of the hero who, against all odds, turns things around (stops the downtrend), endures great opposition (breaking above prior support which is now resistance, reversing the downtrend) and somehow saves the day or saves the world (breaking out to all-time highs).

Enjoy your summer!

Disclosures & Important Information

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through WCG Wealth Advisors, LLC, an SEC registered investment advisor. WCG Wealth Advisors, LLC and The Wealth Consulting Group are separate entities from LPL Financial. LPL Tracking Number: #746780

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Government bonds are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. You cannot invest directly in an index. Consult your financial professional before making any investment decision.