Weekly Market Commentary 12-14-2020

The Markets

When it comes to beverages, frothy can be delicious.

In what may be the least inspiring description of fizzy drinks ever written, a group of food engineers explained, “Aeration in beverages, which is manifested as foam or bubbles, increases the sensory preference among consumers.”

Stock markets can fizz up, too. Share prices bubble, enthusiastic investors invest, and prices go even higher. In a frothy market, share prices often rise above estimates of underlying value. The terms that describe this financial market phenomenon include irrational exuberance, animal spirits, and overconfidence.

Last week, there was speculation about whether some parts of the U.S. stock market have gotten frothy. Eric Platt, David Carnevali, and Michael Mackenzie of Financial Times wrote about an initial public offering (IPO) of stock by a hospitality company. They reported:

“…[the share price] more than doubled in value on Thursday in a return to the kind of mammoth pops that came to define the dotcom boom of the late 1990s…It’s a sign of frothiness, a sign of incredible demand, a sign of a retail investor that…just wants to get in.”

That observation about investor enthusiasm for stocks was supported by the AAII Sentiment Survey. Last week, 48.1 percent of participants were bullish. The long-term average is 38 percent. (Some believe the survey is a contrarian indicator. When bullishness is stronger than usual, contrarian investors would adopt a bearish stance, and vice versa.)

Despite IPO fervor, major U.S. stock indices finished lower last week. The decline has been attributed to a lack of new stimulus from Congress rather than concerns about high share prices. Inflation worries may have played a role, too. Last week, headlines in both The Economist and The Wall Street Journal suggested the post-pandemic world may include higher inflation.

Wall Street’s fear gauge, the CBOE Volatility Index edged higher last week, reported Ben Levisohn of Barron’s. It’s at about 24.6, which is above its long-term average of 19. That’s a sign markets may be volatile during the next few weeks.

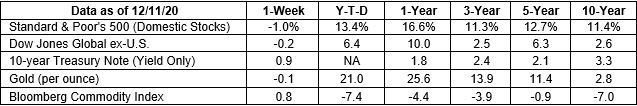

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

A holiday season like no other.

The coronavirus, which The Economist estimates has infected one-in-five Americans, is reshaping holiday traditions this year. “COVID-19 is playing on shoppers’ psyches as they weigh its impact on their health and finances. But, as we’ve seen with previous periods of recession, as well as those of growth, consumers are resilient and will adjust their habits to adapt,” reported Deloitte’s 2020 holiday retail sales consumer survey report:

- 33 percent of survey participants were in a worse financial position than last year, especially those in lower income groups.

- 40 percent planned to spend less on the holidays than they did last year because they are concerned about the economy.

- 51 percent were anxious about shopping in stores because of COVID-19. Deloitte estimated shoppers would spend about $390 of their holiday budgets in stores and $892 online.

The Deloitte survey identified four types of holiday shoppers:

- The Festive Shopper: “These shoppers are all about buying gifts for others, keeping up with conventional shopping routines. They also outspend other types of shoppers.”

- The Conscious Shopper: “These shoppers care about society and are willing to ‘put their money where their mouth is’ by paying more for socially responsible products.”

- The Deal-Seeker: These shoppers “…enjoy the search for the right gift at the right price and will spend weeks shopping. [They’re] up for browsing and sifting through digital platforms, including social media, for attractive options.”

- The Efficient Shopper: These shoppers “…aren’t in the mood to browse or get caught up in time-sucking events, like Black Friday. Shopping is a task and they’ll seek out the easiest way to get it done.”

Do you recognize yourself in any of these descriptions?

Weekly Focus – Think About It

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.” --Warren Buffett, Investor

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, and not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://link.springer.com/article/10.1007/s12393-020-09213-4

https://www.investopedia.com/terms/i/irrationalexuberance.asp

https://www.investopedia.com/terms/a/animal-spirits.asp

https://www.investopedia.com/terms/f/froth.asp

https://www.ft.com/content/cfdab1d0-ee5a-4e4a-a37b-20acfc0628e3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_FinancialTimes-Wall_Street_IPO_Bonanza_Stirs_Uneasy_Memories_of_90s_Dotcom_Mania-Footnote_5.pdf)

https://www.aaii.com/sentimentsurvey?

https://www.aaii.com/journal/sentimentsurveyarticle

https://www.investopedia.com/terms/c/contrarian.asp

https://www.economist.com/leaders/2020/12/12/after-the-pandemic-will-inflation-return (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_TheEconomist-After_the_Pandemic_Will_Inflation_Return-Footnote_10.pdf)

https://www.wsj.com/articles/goodbye-covid-hello-inflation-11607618398 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_WSJ-Goodbye_COVID_Hello_Inflation-Footnote_11.pdf)

https://www.barrons.com/articles/airbnb-and-other-soaring-ipos-cant-lift-the-stock-market-why-thats-good-news-51607735116?refsec=the-trader (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_Barrons-The_Dow_Snapped_Its_Two-Week_Winning_Streak-Why_this_Weeks_Pause_was_Good-Footnote_12.pdf)

https://www.economist.com/graphic-detail/2020/12/10/almost-one-in-five-americans-may-have-been-infected-with-covid-19 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_TheEconomist-Almost_One_in_Five_Americans_may_have_been_Infected_with_COVID-19-Footnote_13.pdf)

https://www2.deloitte.com/us/en/insights/industry/retail-distribution/holiday-retail-sales-consumer-survey.html (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-14-20_Deloitte-2020_Holiday_Retail_Sales_Consumer_Survey-Footnote_14.pdf)