Weekly Market Commentary 10.24.2022

The Markets

Markets turned – again.

Markets continue to be volatile. Last week, stocks headed north. Nicholas Jasinski of Barron’s reported the change of direction reflected investors’ desire for the market to finally hit bottom. He may be right, but corporate earnings suggest we are not there yet, according to Bob Pisani of CNBC.

Corporate earnings season is underway. It’s the time when management tells shareholders how their companies performed during the previous quarter. With 20 percent of S&P 500 companies reporting actual results for the three-month period that ended September 30, the blended* earnings growth rate was 1.5 percent. That’s a slower pace of growth than we saw during the previous quarter, but earnings are still growing. The blended net profit margin was 12 percent, which is above the five-year average, reported John Butters of FactSet.

Yields for United States Treasury bonds rose several times last week, too, although they moved a bit lower on Friday. The yield on a two-year U.S. Treasury note was 4.49 percent at week’s end. In fact, yields for many maturities of U.S. Treasuries were above four percent last week.

That’s important for investors who need their savings and investments to deliver income. During the past decade, with bond yields hovering at very low rates, some income investors added higher-risk bonds and dividend stocks to their portfolios to meet their income goals. Now, those investors may be able to find the income they need in investments with less risk – and that could push the stock market lower as investors move money out of stocks and into bonds.

“Stocks are certainly cheaper than they were at the start of the year, when the S&P 500 traded at 21 times forward earnings. It has since seen its multiple contract to less than 16 times [forward earnings]. But relative to bonds, equities are more expensive than at the start of the year,” reported Barron’s. “The equity-risk premium – stocks’ earnings yields minus Treasury yields – is around 3.5% today. It was 4% in January and nearly 7% during the 2007-09 financial crisis,” reported Nicholas Jasinski of Barron’s.

An equity risk premium is the additional return an investor receives for taking on the higher risk of investing in stocks.

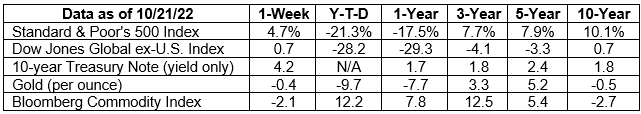

Last week, major U.S. stock indices finished higher.

*The blended rate combines actual earnings/profits for companies that have reported with consensus estimates for companies that haven’t yet reported.

Looking for the perfect holiday gift for a child or young adult?

Here’s an idea: Give them a great education. Parents and family members are already educators. One way older generations help educate younger generations is by sharing wisdom and offering guidance and emotional support. Another way to provide education is by funding a 529 Education Savings Plans to help with the expense of K-12 school tuition, college expenses and some types of apprenticeship costs, reported savingforcollege.com.

529 Education Savings Plans have been an attractive way to fund education for a long time. Typically, after-tax contributions to the plans are invested and any earnings grow tax-deferred. If distributions are used to pay qualified education expenses, they may be tax-free.

There was a drawback to these plans: qualified distributions from non-parent-owned 529 plans were treated as untaxed income of the beneficiary. Since a student’s income plays an important role in determining financial aid eligibility, a distribution from a non-parent-owned 529 plan had the potential to reduce the amount of financial aid a student received by 50 percent, reported Kiplinger.

However, the Consolidated Appropriations Act included a simplification of the Free Application for Federal Student Aid (FAFSA). Beginning with the 2024-25 school year, distributions from 529 plans owned by third parties will no longer be treated as untaxed income, so a student’s financial aid eligibility remains unaffected.

529 plans also can be effective estate and gift planning tools. From a planning perspective, contributions to 529 accounts are gifts to the beneficiary. In 2022, the annual gift tax exclusion, per donee, is $16,000. So, a 529 plan account owner could contribute up to that amount without triggering gift taxes. Alternatively, the IRS allows larger contributions to be made up front and treats them as though the amount was contributed over a five-year period, without incurring gift tax.

If you would like to learn more or gift an education to a child, get in touch.

Weekly Focus – Think About It

“Every child deserves a champion – an adult who will never give up on them, who understands the power of connection and insists that they become the best that they can possibly be.”

—Dr. Rita Pierson, educator

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/stock-market-volatility-51666397996?refsec=the-trader&mod=topics_the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/10-24-22_Barrons_The%20Stock%20Market%20Had%20a%20Great%20Week_1.pdf)

https://www.cnbc.com/2022/10/17/the-earnings-apocalypse-has-not-yet-materialized.html https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_102122A.pdf

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202210 https://www.investopedia.com/terms/e/equityriskpremium.asp#:~:text=The%20term%20equity%20risk%20premium,risk%20in%20a%20particular%20portfolio.

https://www.bloomberg.com/markets/stocks/world-indexes/americas

https://www.savingforcollege.com/intro-to-529s/what-is-a-529-plan

https://www.irs.gov/businesses/small-businesses-self-employed/whats-new-estate-and-gift-tax

https://twitter.com/tedtalks/status/1495153720518193152?lang=en