Weekly Market Commentary 10.23.2023

Stay calm and consider the big picture.

Today, investors have a myriad of worries that are creating tremendous uncertainty. A September Investopedia survey found investors are concerned about how their investments may be affected by:

- Inflation (59 percent),

- The upcoming election (52 percent),

- A possible recession, (51 percent)

- Higher interest rates, (51 percent)

- U.S.-China tension, (44 percent)

- War in Ukraine (35 percent),

- The United States’ credit rating downgrade (33 percent),

- Climate disasters (20 percent), and other issues.

Now, they’re also concerned about war in the Middle East.

Sometimes, in the midst of uncertainty, it can be helpful to take a step back and look at the bigger picture. Consider the historical performance of the Standard & Poor’s (S&P) 500 Index. The current version of the Index debuted in 1957. That year, its average closing price was 44.42. Last week, the Index closed at 4,224.16.

The S&P 500 didn’t travel in a straight line; a lot happened over that 66-year period. The United States experienced 10 recessions. The world witnessed dozens of wars, uprisings and regime changes. The Berlin Wall was built and torn down. Neil Armstrong walked on the moon. Russia defaulted on its debt and recovered. China and the U.S. normalized relations. The Chinese economy grew rapidly, as did the economies of many emerging countries. Americans experienced hurricanes Katrina, Sandy, Harvey and Irma, the savings and loan bailout, the global financial crisis, the Great Recession, 9/11, the COVID-19 pandemic, and so much more.

Some events roiled financial markets while others had little effect. When events have led to the S&P 500 losing value, the Index recovered. Sometimes it recovered quickly, sometimes it took more time. For example:

- During the global financial crisis, the S&P 500 dropped from a high of 1,565 in 2007 to a low of about 752 in 2008. By 2013, it was trading at 1,848.

- At the start of 2020, when the COVID-19 pandemic arrived, The Index was at 3,258. It dropped to about 2,237, and then finished the year at 3,756.

- In 2022, when Russia invaded Ukraine, the S&P 500 started the year at 4,097 and fell to 3,577 following the invasion. By January of 2023, the Index was trading at 4,229.

In each case, the Index recovered and moved higher over time. Of course, past performance is not indicative of future results.

Investor concerns about geopolitical events and market volatility can lead to poor decision-making, including investors selling stocks or moving to cash at times when they might be better off holding onto their portfolio or adding to it. The goal of investing is to buy low and sell high, but that takes enormous discipline. When investors see the value of their portfolios falling, they may become fearful and sell.

That can lock in losses and cause investors to miss out when the market rebounds.

Falling share prices can create opportunities to buy sound companies at attractive prices. If you would like to discuss opportunities in the current market or if you have concerns about the performance of your savings and investments, please get in touch. Together, we’ll review your financial goals, risk tolerance and portfolio allocation.

Last week, U.S. stock and bond markets headed lower after Federal Reserve Chair Jerome Powell indicated the fight against inflation is not over and rates are likely to stay higher for longer, reported Connor Smith for Barron’s. Yields on U.S. Treasuries moved higher.

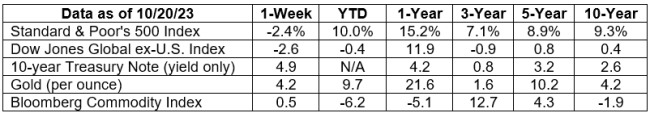

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

HOW COULD A GOVERNMENT SHUTDOWN AFFECT MARKETS AND THE ECONOMY? One event that did not make the September Investopedia survey’s list of investor worries was the possibility of a government shutdown.

To date, Congress has failed to approve funding for the discretionary spending portion of the fiscal 2024 U.S. budget. Temporary spending is in place until mid-November; however, if Congress doesn’t take action soon, the government may shut down. A key issue is that the House of Representatives is experiencing a leadership vacuum and is currently unable to conduct business, reported Billy House, Erik Wasson and Ari Natter of Bloomberg.

When the government shuts down, “…many federal employees are told not to report for work, though under a 2019 law they get paid retroactively when the shutdown ends. Government employees who provide what are deemed essential services, such as air traffic control and law enforcement, continue to work, but don’t get paid until Congress takes action to end the shutdown,” explained David Wessel of Brookings Institute.

“Benefits such as Social Security and Medicare continue to flow because they are authorized by Congress in laws that do not need annual approval (although the services offered by Social Security benefit offices may be limited during a shutdown). In addition, the Treasury can continue to pay interest on U.S. Treasury debt on time,” continued Wessel.

The good news is shutdowns tend to have little effect on U.S. stocks. Since 1976, there have been 20 government shutdowns. The S&P 500 Index lost value nine times and gained value 10 times. One shutdown lasted only a few hours and didn’t have much effect on markets, reported Krystal Hur of CNN, citing data from Strategas Research Partners.

The bad news is government shutdowns can temporarily slow economic growth. “A government-wide shutdown would directly reduce growth by around 0.15 percentage point for each week it lasted, or about 0.2 percentage point per week once private sector effects were included, and growth would rise by the same cumulative amount in the quarter following reopening,” wrote Goldman Sachs Chief U.S. Political Economist Alec Phillips.

Events like government shutdowns and the pandemic highlight the importance of having several months of savings set aside in an emergency savings account.

Weekly Focus – Think About It

"Fear is the most contagious disease you can imagine. It makes the virus look like a piker.”

—Warren Buffett, investor and philanthropist

Best regards,

The Wealth Consulting Group

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stocks of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.cnn.com/2023/10/13/investing/premarket-stocks-trading-defensive-assets-war/index.html

https://www.macrotrends.net/2324/sp-500-historical-chart-data

https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions

https://www.nasdaq.com/articles/a-short-history-of-the-great-recession# (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-23-23_Barrons_Data_5.pdf)

https://www.barrons.com/market-data (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-23-23_Barrons_Stocks%20Continue%20Falling%20Following%20Powell%20Remarks_6.pdf)

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202310 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-23-23_Bloomberg_Trump%20Ally%20Jordan%20Loses%20Third%20Speaker%20Vote_8.pdf)

https://www.cnn.com/2023/09/28/investing/premarket-stocks-trading-government-shutdown/index.html

https://www.goldmansachs.com/intelligence/pages/the-cost-of-a-us-government-shutdown.html

https://money.usnews.com/investing/articles/8-best-warren-buffett-quotes-of-all-time