Weekly Market Commentary 09.12.2022

The Markets

Central banks are hawkish. Stocks popped higher, anyway.

Last week, despite signs that inflation is slowing, U.S. Federal Reserve (Fed) officials emphasized their commitment to tightening monetary policy to lower inflation. Several indicated they anticipate a third consecutive rate hike of 75 basis points, reported Craig Torres and Matthew Boesler of Bloomberg.

Investors seemed to disregard the Fed as U.S. stocks moved higher, snapping a three-week losing streak. The Standard & Poor’s 500 Index finished the week up 3.6 percent, the Dow Jones Industrial Average gained 2.7 percent, and the Nasdaq Composite rose 4.1 percent, reported Christine Idzelis and Joseph Adinolfi of MarketWatch.

The European Central Bank (ECB) announced a rate increase of 75 basis points and revised its expectations for inflation higher last week. The ECB emphasized that tightening will continue and more rate hikes are likely. European stocks rose following the ECB’s announcement, reported Karen Gilchrist and Katrina Bishop of CNBC.

Last week’s stock market gains were a bit confounding, especially when you consider the fact that money has been flowing out of global equities and bonds and into cash and investments that are perceived to be safe havens. The stock market’s performance may be the result of investors whose only option was to buy shares. Bloomberg’s Lu Wang and Isabelle Lee explained:

“In a week that saw discretionary buyers beat a quick retreat from risky assets, another set of traders stood up to halt a three-week plunge in the S&P 500: those with little choice but to buy. They included short sellers, whose rush to cover lifted stocks [that] they’re betting against to gains of more than twice the market’s. Options dealers were another bullish force after getting caught needing to boost hedges by buying stocks when they rise.”

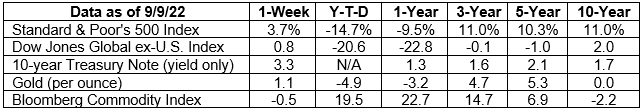

Major U.S. stock indices moved higher last week, and U.S. Treasury yields moved higher across the yield curve.

STAY SAFE WHEN MAKING PEER-TO-PEER PAYMENTS.

Peer-to-peer (P2P) payment apps let you quickly send money to other people from a bank account, credit card or another source. All you need is their phone number, email address or username. P2P apps are convenient ways for friends to split the bill for dinner, roommates to pay their share of utility, streaming, or other bills, and parents to send money to children, reported Ellen Sheng of CNBC.

Before getting too comfortable with the convenience of P2P apps, it's important to understand their risks and limitations. “No app provides fraud protection beyond tools to protect your account. If you authorize a payment and the transaction turns out to be a scam or fraud, there’s not much you can do. If your account is hacked, you can reach out to customer support for help. In any case, treat your electronic payments with the same care you apply to cash payments,” reported The New York Times’ Wirecutter.

According to Consumer Reports, there were more than 70,000 reports of fraud in mobile payment apps in 2021. Here are a few things to consider and some steps to take to protect your money when using P2P payment apps.

- Download apps from a safe source. Only download apps from recognized app stores. Banks and businesses that offer payment apps often have links on their websites, according to Malwarebytes Labs. If you’re not sure whether the app source is legitimate, ask someone you trust for help.

- Enable security settings. Use the account settings to turn on additional security measures, such as two-factor authentication. Also, if you will be making payments via phone, make sure your phone is protected by a password, fingerprint identification or facial recognition.

- Don’t send money to strangers. Most apps recommend using P2P apps only with friends and family. That’s because, once you send the money, it’s gone. If a typo results in the transfer of $500 rather than $50, the mistake isn’t correctable unless the receiver sends the overpayment back.

- Check the information twice. Some banks limit the amount that can be sent through P2P apps because transactions cannot be cancelled. So, double-check the phone number, email address, or username before you choose “send”.

- Connect your P2P service to a credit card instead of a bank account. “Credit cards are subject to the Electronic Fund Transfers rule (Regulation E), which requires that users be held liable for no more than $50 in the event of fraud or a payment made in error,” reported Consumer Reports.

Digital transfers are handy. That may be one reason P2P payments and digital banking are becoming more common. To stay safe, make sure to protect your login information and know who is receiving the money.

Weekly Focus – Think About It

“I know of no single formula for success. But over the years I have observed that some attributes of leadership are universal and are often about finding ways of encouraging people to combine their efforts, their talents, their insights, their enthusiasm and their inspiration to work together.” —Elizabeth Alexandra Mary Windsor, Queen Elizabeth II

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bloomberg.com/news/articles/2022-09-10/fed-rush-to-cool-inflation-set-to-continue-with-another-big-hike (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/2022-09-12_Bloomberg_Fed%20Rush%20to%20Cool%20Inflation%20Set%20to%20Continue%20with%20Another%20Big%20Hike_1.pdf)

https://www.cnbc.com/2022/09/09/european-markets-look-set-to-rise-after-record-ecb-rate-hike.html

https://www.reuters.com/markets/europe/global-markets-flows-graphic-2022-09-09/

https://www.bloomberg.com/news/articles/2022-09-09/forced-buying-puts-a-floor-under-stocks-nobody-else-wants-to-own?leadSource=uverify%20wall (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/2022-09-12_Bloomberg_Forced%20Buying%20Puts%20a%20Floor%20Under%20Stocks%20Nobody%20Else%20Wants%20to%20Own_5.pdf)

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/2022-09-12_Barrons_Data_6.pdf)

https://www.nytimes.com/wirecutter/money/mobile-payment-apps-privacy/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/2022-09-12_New%20York%20Times_Which%20Mobile%20Payments%20are%20Most%20Private%20and%20Secure_9.pdf)

https://www.consumerreports.org/digital-payments/how-to-protect-peer-to-peer-payments-a1478958356/

https://www.consumerreports.org/digital-payments/the-truth-about-those-peer-to-peer-payment-apps/

https://www.brainyquote.com/quotes/queen_elizabeth_ii_461461