Weekly Market Commentary 06.27.2022

The Markets

Last week, bad news was good news.

Consumers were feeling blue in June, according to the University of Michigan Consumer Sentiment Survey. The survey scored sentiment at 50, which was the lowest level on record. Surveys of Consumers Director Joanne Hsu reported that 79 percent of consumers anticipate business conditions will decline during the next 12 months, and almost half indicated they are spending less because of inflation.

Consumer pessimism was reflected in the S&P Global Flash US Composite PMI™. The Index measured that manufacturing growth was at the lowest level in almost two years. “Declines in production and new sales were driven by weak client demand, as inflation, material shortages and delivery delays led some customers to pause or lower their purchases of goods,” reported S&P Global. The Index was at 52.4. Any reading above 50 indicates growth.

Unhappy consumers and slower growth in manufacturing made investors very happy. Consumer spending drives the economy. So, if consumers begin to spend less and economic growth slows, then the Federal Reserve may slow its rate hikes or raise rates by less. Last week Fed Chair Jerome Powell told Congress:

“The tightening in financial conditions that we have seen in recent months should continue to temper growth and help bring demand into better balance with supply…Over coming months, we will be looking for compelling evidence that inflation is moving down, consistent with inflation returning to 2 percent. We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy.”

Despite their pessimism, consumers’ expectations for inflation moved lower in June. They anticipate inflation will be about 5.3 percent in the year ahead, and in the range of 2.9 percent to 3.1 percent over the longer term.

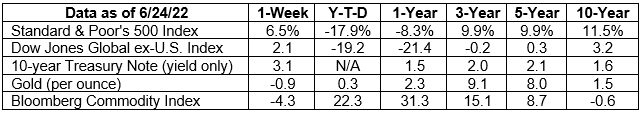

Last week, major U.S. stock indices rallied, reported Emily McCormick of Yahoo! Finance. Yields on shorter maturity Treasuries moved higher last week, while yields on longer maturity Treasuries moved lower.

WHAT DO YOU LIKE ABOUT WHERE YOU LIVE?

People choose where to live for a variety of reasons. They may live where they grew up or where their company is located. They may choose a city or town because they like the culture and environment, need accessible healthcare or prefer a certain school district.

Every year, the Economist Intelligence Unit (EIU)’s Global Liveability Index considers 30 factors in five categories – stability, health care, culture and environment, education and infrastructure – to assess living conditions in more than 170 cities around the world. Its goal is to determine which are the most “livable.” For the last two years, COVID-19 issues (demand for healthcare facilities, closures and capacity limits for schools, restaurants and cultural venues) also have been considered.

In 2022, the average global liveability score improved from COVID-19 lows and was closing in on pre-pandemic norms. The top five “most livable” cities were:

1. Vienna, Austria

2. Copenhagen, Denmark

3. Zurich, Switzerland

4. Calgary, Canada

5. Vancouver, Canada

The five “least livable” cities were:

168. Karachi, Pakistan

169. Algiers, Algeria

170. Tripoli, Libya

171. Lagos, Nigeria

172. Damascus, Syria

The War on Ukraine affected some cities’ rankings. “There is no score in 2022 for Kyiv because the EIU’s correspondent had to abandon the survey when fighting broke out. Moscow and St. Petersburg have dropped 15 and 13 places to 80th and 88th...Other cities affected by the contagion of war, such as Budapest and Warsaw, saw their stability scores slip as geopolitical tensions increased. If the war continues throughout this year, more cities could suffer disruption to food and fuel supplies. The welcome rise in livability this year might be short-lived,” reported The Economist.

Weekly Focus – Think About It

“When you take a flower in your hand and really look at it, it's your world for the moment. I want to give that world to someone else. Most people in the city rush around so, they have no time to look at a flower. I want them to see it whether they want to or not.” —Georgia O'Keeffe, artist

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

http://www.sca.isr.umich.edu (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-27-22_Surveys%20of%20Consumers_Final%20Results%20June%202022_1.pdf)

https://www.pmi.spglobal.com/Public/Home/PressRelease/8fd15c4803fd4399bea8d16e1dc06422

https://www.federalreserve.gov/newsevents/testimony/powell20220622a.htm

https://finance.yahoo.com/news/stock-market-news-lives-updates-june-24-2022-113334665.html

https://www.economist.com/graphic-detail/2022/06/22/the-worlds-most-liveable-cities (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/06-27-22_The%20Economist_The%20Worlds%20Most%20Livable%20Cities_6.pdf)

https://www.brainyquote.com/quotes/georgia_okeeffe_138692?src=t_city