Weekly Market Commentary 02.28.2022

Weekly Market Commentary

February 28, 2022

The Markets

Last week, Russia invaded Ukraine.

Russian President Vladimir Putin’s decision ignited the biggest military conflict in Europe since World War II. The war is already exacting a terrible human toll. It has also disrupted global markets and raised questions about the potential economic impact on Russia, Ukraine and the rest of the world.

The Russia Trading System (RTS) Index, which is a gauge of the Russian stock market, dropped 38 percent early last week, although “financial markets partially recovered during Friday’s session…as traders assessed a wave of sanctions imposed by western powers that spared the country’s energy sector on which other parts of Europe are strongly dependent,” reported Robin Wigglesworth and colleagues at Financial Times (FT).

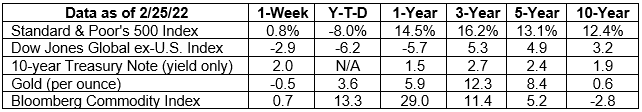

Major stock indices in the United States, Europe and Asia declined sharply at the start of last week, too. Some U.S. stock indices experienced corrections, meaning they moved 10 percent lower than recent highs. While corrections are unpleasant, they’re not uncommon and they can help wring excess from frothy markets, reported Stan Choe of Associated Press (AP).

Last week’s drop was jolting, but major U.S. indices recovered to finish the week higher. European and Asian indices recovered some losses but finished the week lower. The RTS ended the week significantly below where it started.

Will the Federal Reserve Change Course?

One reason for the quick recovery in U.S. markets may have been related to the Federal Reserve. Avi Salzman of Barron’s wrote that some investors “are clearly betting that the Federal Reserve will slow its tightening in response, giving riskier assets a chance to rise more.”

Not everyone shares that perspective. Colby Smith and Caitlin Gilbert of FT reported, “Despite the sharp escalation in geopolitical tensions, market expectations for the future path of Fed policy have not wavered significantly, with six quarter-point rate rises still penciled in for this year. While several Fed officials have since acknowledged potential economic costs tied to Russia’s attacks, they appear steadfast in their plans to withdraw monetary support.”

Will China Follow Russia’s Example?

Governments and investors are also keeping an eye on China. The world’s response to Russia, “may affect how Chinese President Xi Jinping does or doesn’t proceed with reclaiming Taiwan, which is much more critical to the global supply chain and thus the U.S. economy and financial markets,” wrote Lisa Beilfuss of Barron’s. “Taiwan’s domination of semiconductor manufacturing is particularly notable at a time when the global chip shortage is one factor behind the everything shortage.”

Beijing has long held that democratically governed Taiwan is part of China, reported Yimou Lee and colleagues at Reuters.

Your Portfolio and Your Financial Goals

The war in Europe will have far-reaching consequences, many of which remain unclear at this point. As a result, markets are likely to remain volatile. While current market conditions may be nerve-wracking for investors, history has shown that selling out of fear, while markets are down, is a poor way to grow assets.

A better choice is to focus on whether your portfolio aligns with your financial goals. If last week’s gut check left you with concerns about risk, give us a call. We’re happy to review your portfolio with you and see whether changes are needed.

WAR IS PUSHING PRICES HIGHER.

Ukraine and Russia are leading providers of key agriculture and energy products. As a result, the war is likely to create shortages of some resources. When demand for a resource is high and the supply is low, prices tend to increase.

In this case, prices of grain, oil and gas, and marine shipping are moving higher because Russia and Ukraine are:

Europe’s breadbasket

Russia and Ukraine grow a lot of wheat and other grains. For the 2021-22 crop year, S&P Global Platts reported that Russia was expected to export 36.5 million metric tons (mm tons) of wheat, while Ukraine was expected to export:

- 22.5 mm tons of wheat,

- 33.5 mm tons of corn, and

- 6.6 mm tons of sunflower oil.

For comparison, the United States is forecast to export about 22 mm tons of wheat in the same period.

Wheat and grain prices have increased sharply since the conflict began, but inflation isn’t the only concern. “The disruption of grain exports from Ukraine and Russia through the Black Sea will probably lead to physical shortages of food in the world, particularly for countries dependent on those supplies… such as Egypt, Tunisia, Morocco, Pakistan and Indonesia,” reported John Dizard of FT.

Critical to Europe’s energy security

Oil prices have been on the rise for more than a year, in part because of supply and demand issues related to the pandemic. Last week, the price of oil rose even higher as investors, “digested the news that the world’s second biggest oil exporter [Russia] had gone to war with a country at the center of a web of energy export infrastructure [Ukraine],” reported Derek Brower and colleagues at FT.

Russia also is the world’s top exporter of natural gas. It supplies about one-third of Europe’s natural gas, which is piped from Siberian fields through Ukraine’s gas transport system to the Eurozone. Some Russian oil also travels through Ukraine to Europe, reported Áine Quinn and Elena Mazneva in Fortune. A disruption in oil and gas supplies could lead to shortages in Europe and push energy prices higher.

Important shipping ports

The Black Sea and the Sea of Azov are home to ports where grain, chemicals, steel and other exports are loaded and shipped to other parts of the world. In the early days of the war, three non-military cargo ships were damaged by Russian air strikes or missiles. As a result, the London marine insurance market changed the risk status of the Russian and Ukrainian waters in the Black Sea and the Sea of Azov, designating them as high-risk regions. The change will increase the costs of shipping and could push global inflation higher.

The war is likely to affect governments, economies and financial markets in additional ways. If you would like to talk about the potential implications, get in touch.

Weekly Focus – Think About It

“Success is not final, failure is not fatal, it is the courage to continue that counts.” —Winston Churchill, British Prime Minister

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://news.un.org/en/story/2022/02/1112732

https://www.ft.com/content/828e786f-fc62-47db-920c-f683211ca853 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-21-22_Financial%20Times_How%20Will%20Geopolitical%20Tensions%20Affect%20Markets_2.pdf)

https://www.barrons.com/market-data (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Barrons_Overview_4.pdf)

https://www.marketwatch.com/investing/index/rts?countrycode=ru

https://www.barrons.com/articles/stock-market-dow-nasdaq-sp-500-oil-51645843821?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Barrons_Stocks%20Ride%20Out%20the%20Initial%20Storm_6.pdf)

https://www.ft.com/content/e2880073-c75c-40ce-aee4-0a179b6c3bfc (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Financial%20Times_Feds%20Expected%20Policy%20Will%20Be%20Too%20Little%20Too%20Late%20on%20Inflation_7.pdfO

https://www.barrons.com/articles/ukraine-russia-china-taiwan-economy-51645837078?mod=hp_HERO (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Barrons_Overlooked%20Risk%20in%20Ukraine%20Crisis_8.pdf)

https://www.spglobal.com/platts/en/market-insights/latest-news/agriculture/022522-interactive-ukraine-russia-conflict-shakes-agriculture-supply-chains-raises-food-security-concerns (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_S&P%20Global_Ukraine-Russia%20Conflict%20Shakes%20Supply%20Chains_10.pdf)

https://www.ft.com/content/b6712657-d6b7-4d56-95f7-849a653d5a66 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Financial%20Times_Ukraine%20War%20Disrupts%20Global%20Market%20for%20Grains_11.pdf)

https://www.ft.com/content/5a7ea3b8-c446-46a9-a836-fce811a97069 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Financial%20Times_The%20New%20Energy%20Shock_12.pdf)

https://fortune.com/2022/02/24/ukraine-export-crossroads-oil-food-metals-key-pipelines-ports-plants-war-russia-arcelormittal/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/02-28-22_Fortune_Ukraine%20is.%20Huge%20Export%20Crossroads_13.pdf)

https://www.lmalloyds.com/lma/jointwar

https://www.bbcamerica.com/blogs/50-churchill-quotes--1015192