Behavioral Challenges: Cognitive Errors & Emotional Biases

Behavioral challenges affect all market participants – investors, economists, analysts, and portfolio managers. Because these impact so many, it’s healthy to review these periodically, try to educate oneself, try to have humility, and try to be self-aware.

Behavioral biases are broken into two categories – cognitive errors and emotional biases. We can find information on these in many places, but today we will be pulling definitions or descriptions from CFA Institute.

Here’s the good news – cognitive errors can be corrected through education as these stem largely from misinformation. They could be belief perseverance biases or information-processing biases.

Belief perseverance biases include conservatism, confirmation, representativeness, illusion of control, and hindsight and often result in mental discomfort when new information conflicts with previously held beliefs.

Information-processing biases include anchoring and adjustment, mental accounting, framing, and availability.

Conservatism – means that we inadequately incorporate new information into our views or forecasts.

Confirmation – this bias refers to our tendency to look for and notice information that confirms our existing beliefs and to ignore or undervalue whatever contradicts them.

Representativeness – new information may seem representative of or familiar to something already classified, but in reality, it may be very different.

Illusion of control – an individual may believe that they can control or influence certain outcomes when they cannot.

Hindsight – refers to believing as though past events were predictable and reasonable to expect.

Anchoring and adjustment – putting too much emphasis on early or initial information while making subsequent decisions or estimates.

Mental accounting – this bias refers to mentally dividing money into different accounts that influence decisions, even though money is fungible. An example of this may be to borrow a large amount of money to purchase a boat when a large amount of cash is available in a vacation fund.

Framing – this bias has to do with answering a question differently because of how it was framed or asked. For example, focusing on the chance for a loss is different from focusing on the chance for a gain.

Availability – this bias has to do with estimating the probability of an outcome based on how easily information may be recalled. For example, people may estimate based on something resonating with them, being categorized easily, or information being easily retrieved.

Emotional biases are harder to correct than cognitive errors as these stem from impulses and intuitions. They arise spontaneously rather than through conscious effort and may be undesired to those feeling them. Often, the best we can do is to identify them and adapt to them.

The six emotional biases are loss aversion, overconfidence, self-control, status quo, endowment, and regret aversion. Let’s look at each.

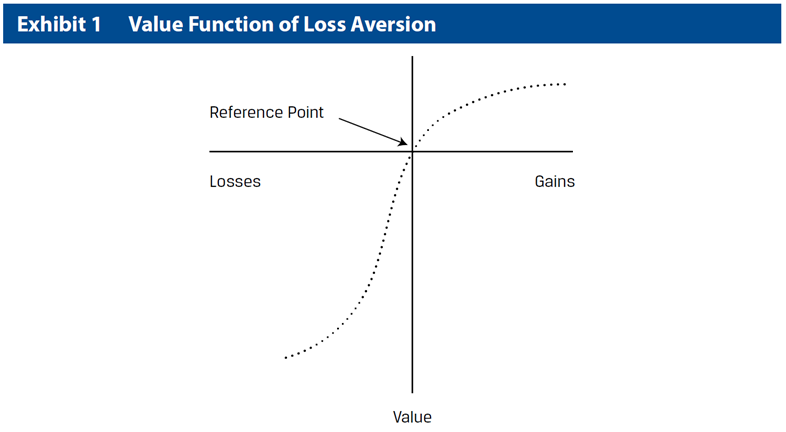

Loss aversion – this refers to the tendency to strongly prefer avoiding losses rather than achieving gains. Paradoxically, investors often accept more risk to avoid realizing losses than to achieve gains. Here’s an illustration of the value function of loss aversion – investors taking more risk with losses (waiting for losers to come back) and limiting risk for gains (selling winners too soon to lock in profits):

Overconfidence – in this bias, investors can demonstrate unwarranted faith in their own abilities. Overconfidence can be amplified if investors are attributing gains to themselves and losses to someone else. There are two forms of overconfidence – prediction overconfidence and certainty overconfidence. We may have confidence intervals that are too narrow (e.g. “the company will either report $1.55 in earnings or $1.56 in earnings”) or we may put too much weight on an outcome happening (e.g. “there is a 98% chance of hitting all-time highs this year”)

Self-control – this bias has to do with individuals focusing on short-term satisfaction at the expense of long-term goals.

Status quo – this emotional bias relates to the tendency to do nothing instead of making a change, even though a change may be warranted.

Endowment – refers to how people value an asset more if they own it than if they do not. Someone who owns a home may believe it is worth more than what they would be willing to pay for it if they didn’t own it.

Regret aversion – this bias has to do with people avoiding making a decision out of a fear that the decision will turn out poorly. This could relate to actions taken or actions that could have been taken and were not. Investors may wish to be invested how the crowd is invested even if the crowd is wrong. John Maynard Keynes once wrote that “Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

In summary, as we are all financial market participants in one way or another, we should all seek to have a systematic way of correcting our biases or moderating our approach when it is difficult to correct. Being self-aware, getting feedback from others, and asking a spouse or a partner can help us learn how to be more disciplined or correct our errors.

Investors can remove some of the emotions and have a systematic approach by working with a financial advisor, by sticking to a financial plan, and by only making adjustments based on pre-determined scenarios or when there are material changes, such as higher or lower income, or a large increase in the asset base, such as an inheritance or settlement.

We can also remember that when our emotions become too correlated with the markets, we may need to unplug and step away from it all for a period. This is especially true because of the 24 hour a day constant media attention on whatever it is that we’re looking at and this can greatly amplify confirmation bias in negative ways. For example, if we are concerned about the markets dropping further, we may find a plethora of information on just such a thing and for someone who is already fearful, they may become even more fearful.

Jim Worden offers investment advice through WCG Wealth Advisors, LLC a Registered Investment Advisor doing business as The Wealth Consulting Group. Jim is not affiliated with LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee for future results. All indices are unmanaged and may not be invested into directly.