Is $40 Trillion a 'Trend'?

ESG - Is it a Trend or an Evolution?

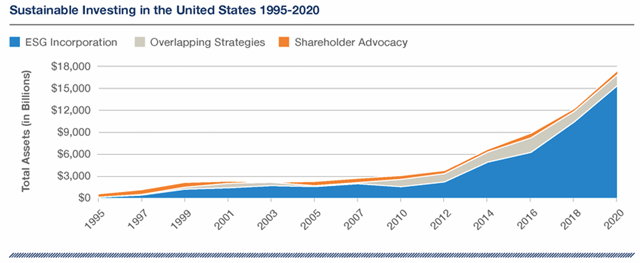

By the end of 2020, ESG-driven assets had reached over $40 trillion globally1. In 2020 alone, sustainable investment fund flows in the U.S. exceeded $31 billion at the end of the third quarter2. With such rapid growth, many advisors are wondering, Is ESG and sustainable investing just another investment trend, or is this an evolution in capital markets? While this remains a debated topic, there are a few key things to note if you're an advisor looking to understand the ESG space.

First things first, it is important to understand that ESG (Environmental, Social, and Governance) factors are used as an additional layer of screening for investment products. You can take any mutual fund, ETF, or stock portfolio and apply ESG screens to identify how well the companies within the portfolio rank in terms of their environmental, social, and governance behaviors. In short, ESG is a tool to identify which companies are behaving better than others, and often times it is found that the better a company behaves, the better it financially performs3.

There are those who feel that the recent surge of ESG fund flows is comparable to a 'stock bubble,' but let's review the facts -- 2020 may have blown the tops off of sustainable fund flows from previous years, but that does not mean there was a lack of investor interest prior to 2020. In fact, numerous empirical studies over the past 10yrs have shown that investors have moderate to high interest in ESG and responsible investing4. The graph below from US SIF's 2020 Trends Report shows a steady increase of ESG incorporated strategies by asset managers from 1995-2020. Is this graph a reflection of a gradual public interest and demand? Or does this graph show that asset managers are playing catchup for investors who have been looking for these solutions all along? Either way, there is no doubt that sustainable investing has made its way to the spotlight and forefront of conversations.

Source: US SIF. (2020) "Report on US Sustainable and Impact Investing Trends 2020".

If one statement holds true in today's digital world - it is that people are watching. They are watching how companies treat, hire, and pay their employees, and they're paying attention to environmental impacts. Scandals, employee safety hazards, pollution, and discrimination are a few examples of the types of non-financial risks that can potentially be avoided by utilizing ESG screens. At its core, sustainable investing is a show of advocacy for the companies whose behavior supersedes the competition.

At the end of the day, is equal opportunity, social justice, public health, and environmental awareness just a trend? Or is ESG another name for continuing the evolution of conscious investors? As the 2020 dust settles, we continue to move forward as a conscious firm who values sustainability and ESG investing. If you'd like to learn more about WCG, our High Impact Portfolios, and our mission to support conscious capitalism, click here.

Disclosures:

Past performance is no guarantee of future results.

Investing in stocks and mutual funds involves risk, including possible loss of principal. The fund value will fluctuate with market conditions, and it may not achieve its investment objective.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value, and may trade at prices above or below the ETF's net asset value (NAV). Upon redemption, the value of fund shares may be worth more or less than their original cost. ETFs carry additional risks such as not being diversified, possible trading halts, and index tracking errors.

References:

Dillian, J. (2020) "ESG Investing Looks Like Just Another Stock Bubble," Financial Advisor Magazine, https://www.fa-mag.com/news/esg-investing-looks-like-just-another-stock-bubble-58287.html?section=43&utm_source=FA+Subscribers&utm_campaign=1569363474-FAN_ESG_News_NYL_EatonVance_101520&utm_medium=email&utm_term=0_6bebc79291-1569363474-238018989

Hale, J. (2020) "Sustainable Funds. U.S. Landscape Report", Morningstar.com, https://www.morningstar.com/lp/global-esg-flows